Open a free account in minutes right from your phone, and make your money go further

How to get started

Wherever you are, use your smartphone or any other device to open your account with a unique European IBAN hassle-free.

Fill the form

Get pre-qualified

Verify your ID

Enjoy our banking

Solutions for any needs

- An alternative to your local bank. Enjoy a more agile and fully-digital money management

- Boost your freelance career. Link the BancaNEO account and card to your freelance platform profile

- Smart payments abroad. Pay and withdraw money at any location around the world

- Being an expat is easy. Benefit from seamless transfers and conversions

Get a card you control

- Pay like a local with excellent exchange rates

- ATM withdrawals worldwide

- Contactless payments

- Personalized pricing plans

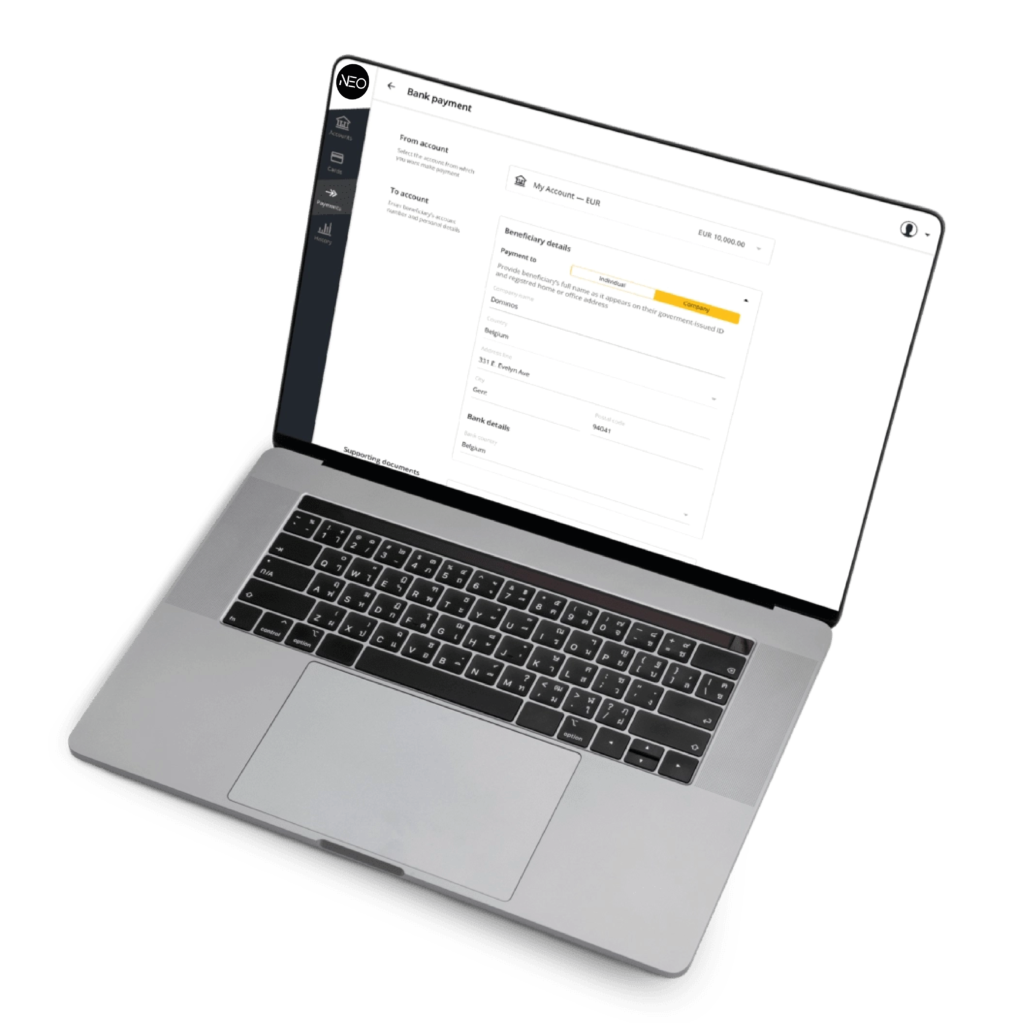

Boost international transfers with SWIFT

- Unique SWIFT for your account

- Transactions in 38 currencies

- Over 100 countries supported

- No hidden fees

Safe & Sound

We adhere to highest EMI security standards to keep your money and personal data safe.

- Client money is stored on a segregated account with the National Bank of Lithuania

- Funds protection using 3D secure and 2FA

Compare NEO Accounts

Choose a plan with the features that fit your lifestyle, or compare plans to figure out which one is right for you

NEO Standard

- Free account opening (for EU resident)

- A unique European IBAN

- Mastercard : Virtual & Physical cards

- A multi-currency IBAN : Transact internationally in 38 currencies

- Instant notifications : See when, where and how you spend

- iOS and Android App: Spend using your phone

- Fee-free BancaNEO bank transfers: Send money to any BancaNEO bank for free

- Unique SWIFT for your account : Over 100 countries supported

- Mass payments: Pay multiple recipients at once

- 100 000 € Guarantee on deposits by the Central Bank of Lithuania

- €4,99 Maintenance Fee

NEO Plus

- All NEO Standard features

- 25% discount on SEPA fees

- 30% discount on the Monthly card fee

- 10% discount on SWIFT fees

- €9,99 Maintenance Fee

NEO Smart

- All NEO Plus features

- Fee-free Mastercard: Physical and Virtual card

- 50% discount on SEPA fees

- €14,99 Maintenance Fee

Here's what you'll get with each account setting

Safe & Sound

Safe & Sound

We adhere to highest EMI security standards to keep your money and personal data safe. Client money is stored on a segregated account with the National Bank of Lithuania.

Human customer support

Human customer support

We believe that having a blended approach- with both human, professional Customer Service Agents, as well as AI solutions- offers an extra layer of reliability.

Add money securely

Add money securely

Adding money just got easier. Transfer as you please, securely. We don’t ask for your bank credentials.

Fast remote account opening

Fast remote account opening

Wherever you are, use your smartphone or any other device to open your account

Boost your freelance career

Boost your freelance career

Link the BancaNEO account and card to your freelance platform profile

Being an expat is easy

Being an expat is easy

Benefit from seamless transfers and conversions

Frequently asked questions

View more Q&A here

Which countries is NEO available in?

NEO provides digital banking solutions to customers all over the world, offering full financial freedom.

You can open an account with us regardless of your citizenship or financial history, but we do have a list of countries that we do not onboard clients from. You can find the full list of Blacklisted jurisdictions on our dedicated web page: “Blacklisted jurisdictions”.

Can I manage my NEO account directly from my smartphone?

Yes, you can easily access your NEO for account via your smartphone by downloading our mobile banking app for iOS and Android.

How old do I have to be to use NEO services?

At the moment, the minimum age for becoming a NEO client is 18.

We are working to lower it down in the future, developing products for younger generations.

Does NEO provide online banking services?

Yes. Any personal or business IBAN account opened with NEO includes free access to our online banking services.

Can I get a card without opening a current account with NEO?

Unfortunately, this option isn’t available. In order to get a card you have to open a current account with NEO.